Double digit Returns ?

Serviced accomodation maths

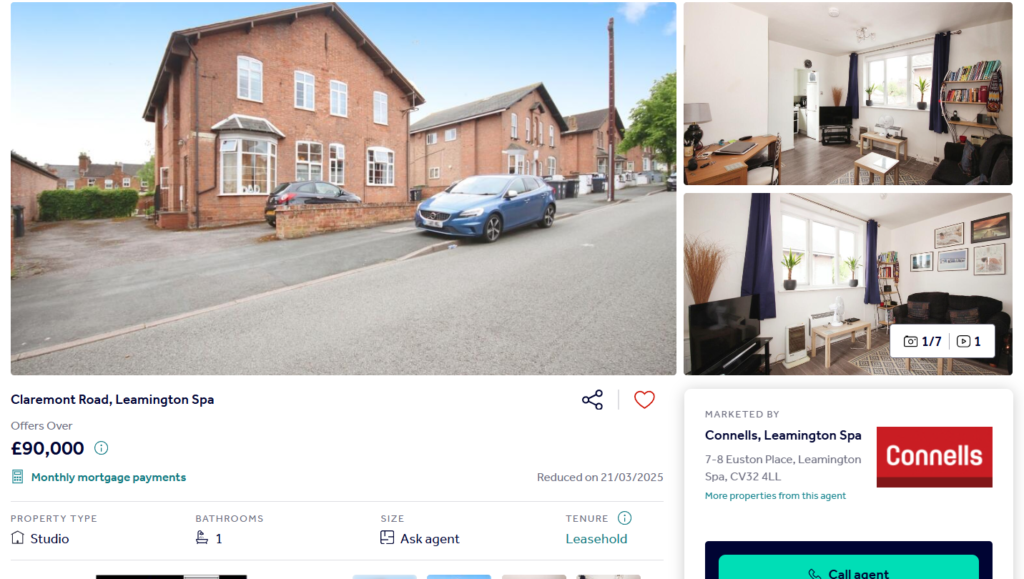

I was perusing Rightmove and came across a studio in the heart of Leamington Spa town, close to the train station. On for £90,000.

Revenue

We can check AirDNA/Booking.com/Expedia for comparable apartments/hotel room prices, a rough estimate is £65 per night. Assuming occupancy of 80%: Revenue is (65*80%*365) £18980.

Expenses

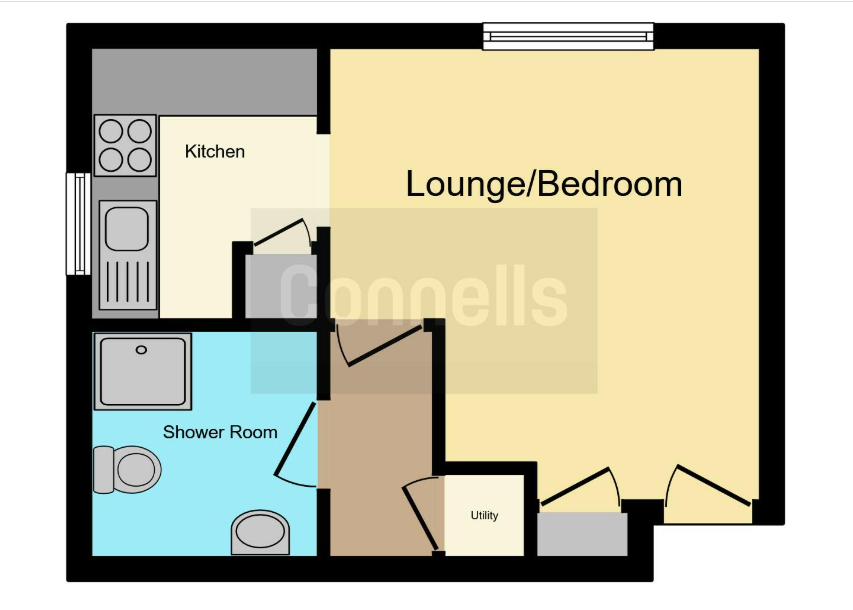

A 75% mortgage at 5%, the Interest cost per year is (5% x 75% * 90,000) £3375. Leasehold service charge (not stated in the add) assume its £1200 per year. Cleaner costs (estimated to be needed 3 times per week and costing £25 each time) £25*52*3 = £3900. Check-in is automated and contactless. Utilities/WIFI/extras roughly (£300 pcm) £3600 per year. OTA commission of 15% of revenue: £18980*15% = £2847

Return on equity

(Revenue – Expenses) / Equity

(18980 – 3375 – 1200 – 3900 – 3600 – 2847) / 22500

This equals 18% Return on Equity